Thanks to Jahan Zahid for letting me borrow his copy over the first few weeks that I joined Indigo in London. Yet short, this book delivers wealth of wisdom regarding what works and what does not work at startups. I was able to see many parallels between what Peter Thiel advocates and my adventure in the world of startups so far. Here is a short summary of the book along with some notes and commentary.

Chapter 1: The Challenge of the Future

Peter Thiel splits progress into two distinct forms.

Horizontal Progress is when small incremental progress is made in a field. In terms of economic activity, companies which follow this pattern simply copy things that work. Thiel calls this pattern one to many.

Copying things that work, going from one to many

1 -> n

Vertical Progress is when dimension shifting progress is achieved in a field. If you're familiar with Andy Grove's terminology, this is like a 10x effect. A progress which gives the company behind it a unique competitive advantage. Vertical progress can be achieved either by inventing something completely new, or by tremendous unusual improvement in a field. Thiel calls this pattern Zero to One. As the title of the book suggests, future is built through Zero to One type of progress, much like the moment of divine creation or Big Bang.

Inventing new things, going from Zero to One

0 -> 1

Chapter 2: Party Like It's 1999

This chapter focuses on the psychology of both the entrepreneurs and investors behind dot com bubble in the late 1990s.

During the dot com mania, dozens of launch parties were held every week in San Francisco. There was an abundance of money in the valley along with exuberant often sketchy people chasing it. Appending .com to your company name increased valuation by half overnight. If the folly of so called smart money was not enough, public markets didn't know any better either. Dot com companies' losses increased as they grew. Defying all laws of logic, public investors still kept throwing money at such companies further inflating their share prices. Music was loud and drinks aplenty, there was no need to be concerned, party was going strong.

Insanity in individuals is something rare - but in groups, parties, nations and epochs, it is the rule.

- Nietzche

In March 2000, NASDAQ reached its peak at 5,048. In 3 weeks time it fell to 3,321 and in October 2002 it fell to the bottom of 3,321. Party was over.

4 main learnings taken by entrepreneurs and investors from this event were as follows:

Incremental changes are the safe path.

Grandiose plans of many dotcom companies failed horribly. Investors should be suspect of anyone who claims of unheard, unseen greatness. Those who want to change the world should be equally humble as their ambitions.

Lean and Flexible

Planning is being arrogant, startups should stay flexible and lean. Make incremental changes, experiment and align course accordingly.

Improve on competition

Small startups should not try to create new markets from the ground up, instead focus on making improvements on established markets.

Product is more important than sales

Technology is more about product than sales, so focus on your product. If you product cant sell itself, it's not good enough. Dot com companies spent so much money on advertising, only viral effects are worth the money.

Right after listing the 4 learnings, Thiel plays devil's advocate and says entrepreurs and investors took the wrong learnings from the dot com bubble. Thiel's learnings are as follows:

- It is better to risk boldness than triviality.

- A bad plan is better than no plan.

- Competitive markets destroy profits.

- Sales matter as much as product.

Obviously neither set of learnings are entirely right or wrong. Thiel wants the reader to think for themselves, reactions to past mistakes can be as wrong as the mistakes made. Stay pragmatic and don't be afraid of being labeled as contrarian.

Chapter 3: All Happy Companies Are Different

According to Thiel, one of the biggest economic lie we are told by the economists is the state of perfect competition which leads to market equilibrium.

The reality is, there is no perfect competition, competition eats away from the same pool of potential profits. In a market with perfect competition, nobody makes any money. Economists are eager to advocate market equilibrium not because it makes economical sense but it is easier to model.

Let's consider the case of Alphabet (Google). Don't be evil has become company's motto. From the outset Alphabet is advocating responsible business ethics, which sounds great. However, it's made possible due to the fact that Google enjoys a monopoly in the internet search market. When was the last time you heard someone say let me Bing that? Google earns 78% of $48.7B US search ad revenues.

Let's move on to the teaching of this chapter, the difference between the mentality of a monopolist and a non-monopolist.

Non-monopolist exaggerate their uniqueness by describing their target market as the intersection of various smaller markets.

Imagine James who moved to Bay Area from London, and he wants to open a restaurant in Bay Area serving British food.

Bay Area ∩ Restaurants ∩ British Food

James is a non-monopolist. By defining his target market in the way he does, he ensures "uniqueness" but he doesn't ask the questions such as "how many other restaurants are there in Bay Area" to get a rational grip on the degree of competition.

In contrast, monopolist disguise their monopoly status by describing their target market as the union of large sectors.

Alphabet is an internet technology company, their target market is something like this.

Internet ∪ Software ∪ Mobile Phones ∪ Search Engines

Monopoly is the condition of every successful business.

Chapter 4: Ideology of Competition

It's not only the economists that are fooled by competition, our society is driven by it!

Bright students at a young age start competing for admissions to elite institutions.

Once they reach there, competition intensifies now the target is to land that management consulting, investment banking or blue-chip engineering position.

Once they land at those prestigious jobs, competition reaches new highs. Vicious circle continues until the intensity of competition reaches to a level that sucks life out of them. That's how the tale of fatalist badge-collecting conformist ends.

Lesson here is that, competition is WAR, and war is a costly business both in terms of time and resources. War should be avoided if it's not worth it. In the case that war is worth having, then you should strike hard and end it quickly. There are no half measures in war.

Chapter 5: Last Mover Advantage

Escaping competition is the first step to building a monopoly, but it should be defensible.

When evaluating fast-growing small companies ask this question:

Will this business still be around a decade from now?

Characteristics of a Monopoly

Proprietary Technology

This should be a significant improvement on top of what's available in the market today, a hard to replicate improvement by competitors. See Andy Grove's "Only The Paranoid Survive" for a further explanation of such changes, he calls them 10x changes.

Network Effects

As the number of users increase, it makes the product as a whole more valuable.

Social networks such as Facebook and LinkedIn exploit this feature. As more people join the network, more valuable it becomes and further enhances the monopoly position.

Ironically, in order to leverage network effects you need to focus on a small target demographics " a niche". Facebook started as a small experiment at Harvard, it didn't go worldwide from day 1.

Economies of Scale

Firms get stronger as sales grow because fixed costs can be spread over a larger quantity of sales.

Software is great industry to exploit this characteristic. The cost of serving the same software to another customer is nearly zero.

Service businesses are disadvantaged in this dimension by their nature.

Barber shops, yoga studios, consultancies can not tap into economies of scale as easily. Serving more customers means they need to open more shops in different locations and employ more people, which in return will increase fixed costs.

Branding

Every company has a divine right to monopoly with their branding. A strong branding is a powerful way to obtain monopoly.

Apple is the pioneering example of this dimension. Their products, websites, shops are all designed with the same minimalist, slick, premium qualities.

Apple also maintains a strong control over all user touch points. This control ranges from physical to digital world, such as geniuses at Apple Stores to many checks done before an app is accepted to the App Store.

So how do you build a monopoly?

Thiel advises startups to start with a small, well-defined target demographics which is clustered in a small geographical area.

It is easier to start with a small target audience rather than a large market. Large markets comes with cut-throat competition, remember what we said about competition in the last chapter?

Amazon started by selling books, then moved into DVDs and CDs before it became a store of everything.

Bezos timed move into adjacent and related markets perfectly to build Amazon to be where it is today.

Please do not disrupt.

Last piece of advice worth mentioning in this chapter is that AVOID DISRUPTING. Media is obsessed by disruptive technology, but most of the time disruptors get disrupted. Don't disrupt. If you intend to do so, well, do it in subtle ways. Disruption attracts the attention of competition as well as regulators. Last people you want to see or hear about.

Chapter 6: You Are NOT a Lottery Ticket

This chapter discusses the four different attitudes to future. These are:

Definite optimism: Future can be predicted and it will be better. Indefinite optimism: Future can NOT be predicted but it will be better. Definite pessimism: Future can be predicted and it will be worse. Indefinite pessimisim: Future can NOT be predicted and it will be worse.

There is no such thing as luck, or in other words, everyone is as lucky as everyone else! You get luckier by working harder and smarter.

Victory awaits him who has everything in order -- luck, people call it.

Roald Amundsen, Norwegian Explorer, first explorer to reach South Pole

Western world is in a state of indefinite optimism right now, compared to definite optimism of the Renaissance, Age of Enlightment and Industrial Revolution periods.

When people lack concrete plans, they start to build a portfolio of various options. This is the dominating viewpoint of Western world now.

In middle school you are encouragee to take on various "extra-cirricular" activities. In high school, most ambitious compete to appear omni-competent, curating a diverse resume to prepare for an "unknowable future".

Come what may, she's ready -- for nothing in particular.

Thiel advocates for the definite optimism. That's how great companies will be built. Instead of pursuing many-sided mediocrity and calling it "well-roundedness", definite optimist strives to be great at something substantive -- to be a monopoly of one.

Chapter 7: Follow The Money

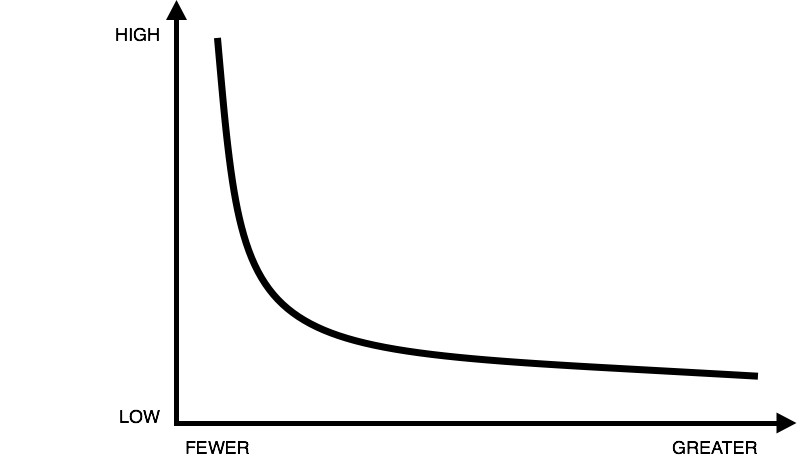

Thiel opens the chapter by introducing the well-known Pareto Principle. This is also known as power law, 80/20 rule.

Italian economist Vilfredo Pareto showed that 20% of population owned 80% of the land in the country. This is a well-known concept taught in business management field, 80% of your sales comes from only 20% of your clients.

In order to maximise process efficiency, you should focus on 20% of the opportunites which would return 80% of the gains.

If we apply the same rule to your distribution channels, you don't need n many channels, you need 1 or 2 that delivers the results.

Whenever you plan to spend some time taking an action, think of the power law and where your action will fall on the power law distribution. Take fewer actions with bigger impact.

Chapter 8: Secrets

This chapter is about the secrets, the magic ingredient which makes a great business.

A secret is a truth which very few people agree with you. In order to uncover secrets, you should be looking for them. Many say there are no secrets left in the world to discover, that's exactly why they won't be finding any.

If you happen to find a secret, you have two options. You either keep it to yourself, or you share it with others. One should note that, it's rarely a good idea to tell everybody everything you know.

Every great busiess is built around a secret that's hidden from the outside. Inner workings of Google's PageRank algorithm, Apple iPhone in 2007 etc...

A great company is a conspiracy to change the world, when you share your secret, the recipient becomes a fellow conspirator.

Personal Note: I don't agree with Thiel that you should guard your ideas from the outside world so obsessively. There is always a risk that someone might steal your idea, but setting up a business and developing a product is HARD work involving lots of sweat, blood and tears. "Conspirator" who is running away with your idea will unlikely have the same level of passion and stamina to see it through. Of course you need to be wise about who you share your ideas with. However, in order to make your ideas reality it is necessary to talk to people, gather feedback and recruit loyal conspirators.

Chapter 9: Foundations

Thiel says it's impossible to fix a start-up which is broken at its foundation. Founding principles are important, once they are set it is hard to amend them later down the line. Since 1791, US Constitution was only changed 17 times.

Co-founders

Being co-founders is like marriage, it's an arduous journey with many ups and downs. Much like that you would not marry the first person you come across at a slot machine in Vegas (slim chance you'll hit the jackpot), you would not start a company with a stranger.

Complementary skillsets and personalities of founders matter, but how well founders know each other and how well they work together matter just as much!

Founders should share a pre-history before they start a company together, otherwise they're just rolling dice.

Personal note: I can not stress enough how important founder's having a pre-history is. I have personally seen 2 cases that conflict between founders put company at the risk of failure, one ending in administration. In both cases, founders barely knew each other before starting a company and their relations started to crack at the first signs of stress.

Conflicts at startups usually stems from misalignment at 3 important dimensions, these are:

- Ownership who legally owns company's equity. (founders, employees and investors)

- Possession who controls day to day operations of the company. (founders and employees)

- Control who formally govern company's affairs. (board of directors and founders)

Make sure each party involved with your startup in one way or another is adequately represented.

Boardroom of a Startup

less is more.

Smaller the board, easier it is for directors to communicate, reach consensus and to exercise oversight. However, the very effective nature of a small board also means that board can oppose management quite easily.

When assembling a small board, you need to pick your directors carefully. Each director matters, and even one can give you a lot of headache and jeopardize company's future.

A board of 3 is ideal for private companies.

If you want to rein freely in a dictatorial style, bloat your board to a massive size which will give you full autonomy. If you want to have an effective board, keep it small!

On the bus, or off the bus

Anyone who doesn't own stock options but regularly draws down salary is MISALIGNED. Their motive would be to extract as much value from the company rather than creating value.

Personal Note: Thiel advocates that everyone at a startup should be full-time and strictly no remote working, but I think times have changed and remote work is perfectly feasible. Furthermore employees would apprecitate a better work/life balance rather than mindless pursuit of capital gain.

Cash is NOT King

High CEO pay encourages CEO to behave like a politician so she can hold on the entitlement longer.

Cash encourages short term thinking rather than long term value creation. So cash incentives and bonuses should be avoided where possible. Equity is the best way to keep everyone aligned for long term vision.

CEO should also set an example either by taking the LOWEST salary or taking the highest but still a MODEST salary. Thiel tells the striking story of Aaron Levie, CEO of Box. 4 years after founding Box, he paid himself lower than everyone else, lived in a one bedroom apartment 2 blocks from the office. His commitment was crystal clear to everyone in the company. Good CEOs lead by example.

Chapter 10: The Mechanics Of Mafia

Early PayPal team is known as the PayPal mafia Valley because members of this early team went on to create many succesful companies such as YouTube, Palantir, Tesla, LinkedIn, Yelp and invested in many others. What was so special about the early PayPal team?

Thiel advocates that a startup should make recruiting fellow conspirators a core competency. Hiring should never be outsourced

Your hires should be like-minded people with similar interests and a passion about the problem domain you're working on.

If a hire is forcing you to have a perk war, simply let them go, they are not passionate enough.

A startup is kind of like a cult, with less dogmatism. In order to foster a strong culture, pay attention to these 4 dimensions.

- Imagery: Techies in SF fashion branded hoodies of the companies they work for, it's a sign of commitment.

- Slogans: Do you have catch-phrases, inside jokes? These help foster stronger relations among the team.

- Advocacy: What is the problem you're working on? Is your company actively publicising its efforts?

- Obsession: Are team members obsessed about solving the problem?

Chapter 11: If You Build It, Will They Come?

Distribution of a product is as important as the product itself. Nerds and geeks are skeptical of salespeople, because from the outset it might seem superficial and irrational.

Advertising exists, because it works. If you think you're prone to advertising you're simply fooling yourself. Advertising is not about making you buy a product right at that moment, but creating recurrent subtle impressions which will drive sales in future.

Technical people are used to producing and evaluating transparent work. If an algorithm is updated, results can be compared to previous run see the impact of change. It doesn't matter how the engineer who wrote the updated algorithm markets it.

In engineering and science, the complexity of the problems to tackle are clearly visible. On the other hand, best type of sales is hidden. Salespeople on endless calls, 2 hour lunches with prospective clients might seem like they're not doing any real work in the eyes of nerds. What nerds miss is that it's hard work to make sales look easy!

We only react abruptly to sales people who are awkward or obvious, the activity of sales at its peak seems invisible. If you think you've never met such a person, you were probably blind to see that you were being sold by a grandmaster.

Best sales is hidden, because people don't like the idea of being sold something. People want to make their own decisions and exercise their right to choose. Hence we rarely see any mentions of sales in salespeople's title.

We call people who sell advertisements - account executives. We call people who sell customers - business development managers. We call people who sell companies - investment bankers. We call people who sell themselves - politicians.

It doesn't matter which profession you're in, even in the realms of academia where its members might like to think they are paragons of reason, study fields are influenced and shaped by few names who are better at getting their papers read and cited by more scholars. For this reason, everyone should work on improving their persuasion and negotiation skills.

If you have invented something but you haven't figured out a way to distribute it, you have a bad business on your hands. You should treat distribution as a fundamental part of your business.

How to sell a product?

You need to keep an eye on two metrics for assessing effective distribution. These are Cost of Acquiring a customer (CAC) and Customer Lifetime Value (LTV).

CAC is the amount of money spent in order to get a customer to buy or use your services.

LTV is the total amount of money a customer will be spending on your products or services. If you are running a SaaS business, this might be annual subscription fee multiplied by number of years customer is likely to use your product.

To have a profitable business, you'll need to satisy this equation:

LTV > CAC

Lifetime value extracted from a user should be higher than the cost of acquiring them. Not exactly rocket science, but it's all about finding the right distribution channel which works for your business.

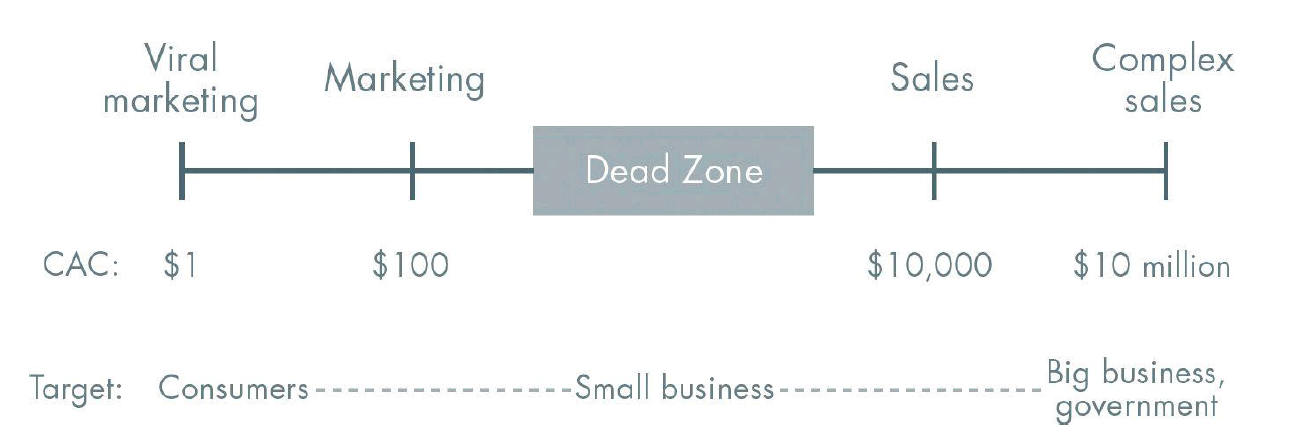

Distribution Spectrum

Depending on the value of each product/service you sell, your distribution effort would fall somewhere among the below spectrum.

1 - Complex Sales

Deal Size: $1m - $100m

Target: Government, Public Corporations, any entity with very deep pockets.

If the deal size ranges between $1m to $100m, CEO needs to be involved at every such deal. You need to start at smaller deal sizes, slowly but methodically grow the size of deals your company is doing.

2 - Personal Sales

Deal Size: $10k - $100k

Target: Consumer or Companies

Such deals may involve mortgages, cars, machinery etc... The trick here is to form an efficient sales pipeline which is scalable! Organizing a small but effective sales team which can push the product to the masses is key.

3 - Dead Zone Sales

Deal Size: around $1k

Target: SMEs

This particular type of deals fall into an unfortunate bracket, where the size of the deal doesn't justify sending a salesperson to close it. On the other hand, because target audience is likely to be small businesses rather than individuals, conventional forms of advertisement is hard to exploit as well. E.g: There is no radio show which is listened by majority of SME owners in an area. Thiel doesn't offer advice on how to escape the dead zone, so if you're selling to SMEs something worth $1k, you need to get creative with your distribution channel.

4 - Small Sales

Deal Size: around $100

Target: Individuals or businesses. Traditional sales and marketing channels are effective for this type of deals. Advertiser needs to refrain from competing directly with bigger brands, this can be achieved with a contrarian brand persona.

5 - Viral Sales

Deal Size: around $1

Target: Individuals, this can be achieved leveraging network effects. Refer a friend, incentive mechanisms and gamification.

Power Law of Distribution

You need to find that one channel which drives majority of your sales. That's the power law of distribution.

Everybody Sells

Look around you, if you don't see any salespeople in your business, that means YOU are the SALESPERSON.

Man and Machine

Unlike his pal, Elon of PayPal, Thiel's outlook on AI is optimistic. He believes man and machine have complementary skillsets and will build the future by working together.

Consider the case of pattern recognition for instance, a 4 year old can identify a cat quite easily whereas a machine would need gigabytes of training data to come close.

Another example is the fraud detection system Thiel and the team built at PayPal. System used a combination of anomaly detection statistics to flag seemingly fradulent transactions and brought those particular cases to the attention of a human controller to be investigated further. Decisions of human controllers were fed back into the software making it a "human in the loop" AI solution.

Thiel's new company Palantir is bridging the gap between two approaches to national security. Historically, there is a stark contrast between CIA and NSA. CIA adopts a human driven approach, whereas NSA is machine driven. Palantir is adopting a hybrid approach, which uses AI/ML driven techniques to gather and analyse data, but relies on human analysts to provide causal explanations and unique insights.

Thiel believes machines will empower humans instead of replacing them. Worrying about AI is a 22nd Century problem, question we should focus on right now is:

“How can computers help humans solve hard problems?”

Personal Note: I've written 2 essays on this subject which give a more balanced outlook on future, you can read the second part where I discuss the impact on employment.

Chapter 13: Seeing Green

Clean-tech bubble in early millennium failed to deliver results. Thiel says this was because clean-tech companies failed to answer any of 7 questions which every business needs to answer.

1 - The Engineering Question

Can you create breakthrough technology instead of incremental improvements?

2 - The Timing Question

Is now the right time to start your particular business?

3 - The Monopoly Question

Are you starting with a big share of a small market?

4 - The People Question

Do you have the right team?

5 - The Distribution Question

Do you have a way to not just create but deliver your product?

6 - The Durability Question

Will your market position be defensible in 10 or 20 years in the future?

7 - The Secret Question

Have you identified a unique opportunity that others don't see?

Whatever your business or industry is, a great business plan will have answers to the above 7 questions. If you don't have good answers to above questions, you'll run into a lot of bad luck in your endeavour. If you nail all 7, you'll master fortune and success.

Chapter 14: The Founder's Paradox

Startup founders tend to have extreme character qualities, this might be due to some form of law of attraction. If you have extreme character qualities you'll find yourself in the company of such people, which will further enhance those extreme qualities.

Another interesting point Thiel makes about startup founders is not only they have extreme qualities; from the outset they might seem to possess very "opposite" type of traits as well.

Founder's startup might be "valued" multiples of millions, but she might be living on a modest salary within a one bedroom apartment. So she might seem poor, but also rich depending on which angle you look.

Founders might seem poor and rich, genius and idiot or hero and villain at the same time. That's the paradox of being a founder.

So be tolerant of the extreme qualities of founders, that's how they can lead companies beyond mere incrementalism.

Single biggest danger for a founder is to become so certain of his own mythical qualities, he loses his mind.

Conclusion: Extinction or Singularity

According to Thiel, there are only 2 possible options facing humanity.

First option is that, we'll go into a horrible decline with the extinction of humankind from the face of earth. Global warming, populist politics, nuclear war, global famine are among the contenders for such a doomsday scenario.

Second option is, the rate of advancement of technology will keep accelarating leading to an exponential take-off.

My personal opinion is I would put my faith on the second option, that's the only outcome worth working for.

I would like to end this summary with the ending scene of the cult 1999 film Matrix. Nobody can predict the future, but we all play our parts in to shape it.

So what part will you play?